The Teenagers Who Are Hacking Pesticides

Two 18-year-old dropouts built AI that screens molecules 700,000 times faster than Big Ag's billion-dollar labs

When Tyler Rose and Navvye Anand dropped out of high school and college respectively to start Bindwell, the pesticide industry barely noticed. After all, what could two 18-year-olds possibly know about an industry dominated by century-old chemical giants with $300+ million R&D budgets per new product?

Six months later, their AI models were screening pesticide molecules at unprecedented speeds — a computational feat that would take traditional methods 242 years to match. By January 2025, they had secured $500,000 from Y Combinatorand signed contracts with major agrochemical companies.

This is the story of how two teenagers who met at a summer coding camp are solving a crisis that has stumped agricultural giants for decades: the fact that pests are evolving faster than we can develop new pesticides, threatening global food security as 20-40% of crops are lost annually to pests despite pesticide use doubling since 1990.

“Most pesticides are carcinogens and they are very harmful to humans. So we plan to make better pesticides that are not only more environmentally safe, but also more targeted solutions.” - Navvye Anand

The Innovation Crisis Killing Crops

To understand why Bindwell matters, one needs to understand how broken pesticide discovery has become. Since 2010, fewer than 40 new active ingredients have entered the global pesticide market — a collapse from the 80-120 compounds introduced every five years during the 1980s and 1990s.

The industry hasn't discovered a new herbicidal mode of action in over 30 years. Most "innovations" are merely tweaks to existing chemicals, like adding a methyl group here or a chlorine atom there. It's the pharmaceutical equivalent of rearranging deck chairs on the Titanic while pest resistance builds like an iceberg ahead.

The economics are brutal: developing a new pesticide now costs $301 million and takes 12.3 years, up from $286 million just five years earlier. Only 1 in 160,000 compounds tested ever reaches market. The EPA approval process alone requires 150 different safety tests and a minimum of six years.

This innovation drought couldn't come at a worse time. The global pesticide market, valued at $45.7 billion in 2024, is projected to reach $92.6 billion by 2032. Yet pest resistance is accelerating, climate change is expanding pest ranges, and regulatory pressure for safer compounds is intensifying.

The Meeting That Changed Everything

June 2023, Wolfram Summer Research Program. Tyler Rose, a high school senior from California with machine learning experience at Wolfram Research, meets Navvye Anand, a 17-year-old math prodigy from India who had just started at Caltech after scoring 100/100 in mathematics on his board examinations.

"We were super surprised," Rose later told El Estoque about their eventual Y Combinator acceptance. "Because Y Combinator was very skeptical about us—with me being in high school and him just being a freshman in college—we were like, 'They'll probably not accept this.'"

But something clicked between the two young engineers. Both had grown up visiting farmlands — Rose in California, Anand in India — giving them firsthand exposure to agricultural challenges. More importantly, they shared a conviction that the same AI revolution transforming drug discovery could be applied to pesticides.

The biochemistry, after all, is nearly identical. Both drugs and pesticides work by binding to proteins. Both require molecular optimization. Both face similar challenges in target validation. Yet while AI drug discovery attracted $60 billion in investment and produced breakthrough after breakthrough, pesticide discovery remained stuck in the 1980s.

Three Models That Broke the Industry

Bindwell's technical breakthrough rests on three AI models that attack pesticide discovery from different angles, each representing a quantum leap in efficiency.

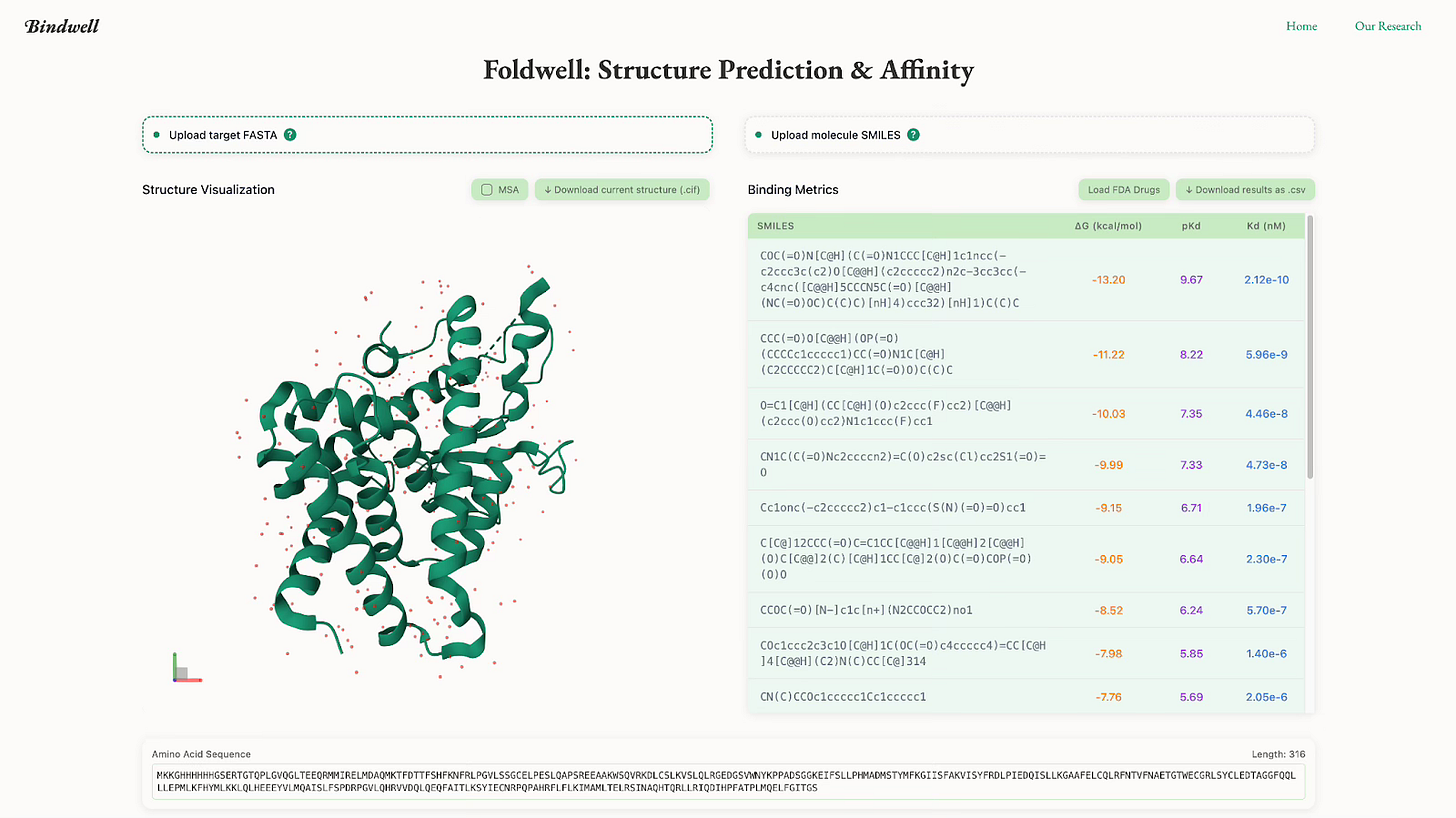

Foldwell, their protein structure prediction model, runs 4 times faster than Google's AlphaFold 3. In an industry where mapping a single pest protein could take months, Foldwell can identify druggable targets across multiple resistant species simultaneously.

PLAPT (Protein-Ligand Affinity Prediction using Pretrained Transformers) is where things get truly ridiculous. When Bindwell introduced PLAPT, they knew it would improve the drug discovery process, but the validation results exceeded even their expectations: PLAPT achieves 1.7x better MSE accuracy while being 470,000x faster than AutoDock Vina — completing in 0.08 seconds what took AutoDock 11.7 hours.

The open-source model can evaluate 700,000 molecules per second on consumer hardware. To put this in perspective: screening all 177 million known synthesized compounds takes Bindwell 6 hours. Traditional computational methods would need 242 years. This breakthrough means pharmaceutical and pesticide researchers can now evaluate hundreds of thousands of candidates in the time it previously took to analyze just one. By leveraging advanced transfer learning from pre-trained transformers and their novel branching neural network architecture, PLAPT is fundamentally transforming how discovery teams work. The code is freely available on GitHub, democratizing access to this revolutionary technology.

The impact has been immediate and profound: PLAPT is now being used in Nature articles for cancer research, validating its scientific rigor. But Bindwell didn't stop there. PLAPT V2 delivers a 21% accuracy increase over the original, with faster inference and a lower memory footprint. The new version includes a web interface, CLI, Python endpoint, and desktop tool, making it accessible to researchers regardless of their technical expertise. The performance gains are striking — while traditional methods struggle to achieve R² values above 0.02, PLAPT consistently outperforms all competitors in binding affinity prediction.

Their third model, APPT (Affinity Protein-Protein Transformers), focuses on biopesticides — the $13.4 billion market growing at 13% annually as farmers seek alternatives to chemical pesticides. APPT sets new benchmarks in the field: it outperforms all current ML models and even Molecular Dynamics/Docking simulations, achieving 40% better accuracy than previous state-of-the-art tools on the MSE metric. Trained on the largest protein-protein binding affinity dataset yet assembled, APPT represents what the founders call being "one step away from solving protein interactions."

The models leverage transfer learning from pharmaceutical AI — essentially teaching pesticide discovery models using lessons from drug discovery. It's an obvious approach in hindsight, yet nobody had successfully executed it at scale until two teenagers decided to try. The results speak for themselves: in comparative R² value testing across different computational methods, PLAPT dramatically outperforms traditional approaches that struggle to exceed 0.02 correlation values.

The Business Model That Shouldn't Work (But Does)

Most startups trying to disrupt the pesticide industry would follow the traditional path: raise hundreds of millions, build labs, hire armies of chemists, and spend a decade navigating EPA approval. Bindwell did something radically different: they decided not to make pesticides at all.

Instead, they license their AI discovery tools to the same agricultural giants they're disrupting. Bayer, Syngenta, BASF, and Corteva — companies that spend billions on R&D — are now Bindwell's customers, not competitors. These companies have the regulatory expertise, manufacturing facilities, and distribution networks that would take Bindwell decades to build. What they lack is the AI capability to discover novel compounds efficiently.

“We have a bunch of the state-of-the-art AI models that we’re selling to biologists who work at agrochemical companies, because the current ones that they use are out of date, slow and not very easy to use,” Rose said. “We basically offer cheaper, faster, more accurate alternatives that’ll help the bottom line of these companies. And we also work with these companies to refine our models on their proprietary data.”

The early traction validates their approach. Major agrochemical companies including Bayer, Syngenta, BASF, and Corteva are already working with them to refine models on proprietary data. Their open-source PLAPT model has been downloaded over 211,000 times on Hugging Face, establishing Bindwell as the technical leader in AI-driven pesticide discovery before they've even graduated from Y Combinator.

Big Ag’s Uncomfortable Truth

Four companies — Bayer, Syngenta, Corteva, and BASF — control 70% of the global market. They spend 7-10% of revenue on R&D, maintain thousands of PhD chemists, and operate massive screening facilities.

Yet they're losing the innovation war. Resistance evolution now outpaces new product development. Weeds resistant to multiple herbicides spread across continents. Insects evolve immunity to pesticides within years of introduction.

Bayer's recent announcement is telling: their first new herbicide mode of action in 30 years, Icafolin, won't launch until 2028 — and they're crediting AI for making it possible at all. Syngenta claims AI will reduce their development timeline by 33% while cutting lab tests by 30%.

These giants recognize an uncomfortable truth: their traditional R&D model is obsolete. Screening millions of compounds manually, even with robotics, can't match an AI that evaluates 700,000 molecules per second. It's not just a speed advantage — it's a fundamentally different approach that can identify novel chemical spaces humans would never explore.

The Future That's Already Here

The biopesticides market alone is projected to reach $13.4 billion by 2030. The broader $92.6 billion pesticide market is ripe for transformation. Early investors are betting that Bindwell won't just participate in these markets — they'll fundamentally reshape them.

Pest resistance is accelerating. Climate change is expanding pest ranges. Global food demand will increase 70% by 2050. We need new pesticides — lots of them, fast — or face catastrophic crop losses.

Imagine a world where developing a new pesticide takes months, not decades. Where AI models predict resistance evolution before it happens. Where pesticides are so precisely targeted they affect only intended pests, leaving beneficial insects unharmed. Where the cost for new compound development drops by 90%.

Bindwell's models are already identifying novel compounds that traditional screening would never find. They're mapping protein targets in resistant species that have stumped researchers for years. They are proving that domain-specific AI models can outperform human experts by orders of magnitude — not by replacing human insight, but by exploring chemical spaces too vast for human comprehension.

There's a pattern I've noticed in venture: the most transformative companies aren't started by industry insiders. Two teenagers looking at pesticide discovery and thinking "this is just a compute problem" is exactly the kind of clarity that precedes revolution.

Roberto Veronese is an investor and limited partner (LP) at Lombard Street Ventures, which invested in Bindwell's first funding round.